The concept of banking has been around for a few centuries and has been evolving at a tremendous pace from the basic money safekeeping service provider to a plethora of services these days. Transformation is drastic from 100% paper-based to paper+digital to 100% digital. Last 2 decades have seen the focus shifting from back end digitization to consumer-facing digitisation. The government along with the banks are trying hard to bank currently unbanked users and going heavy on digitisation. If we continue to grow with branch-based banking approach, it would take a few more decades to reach substantial coverage. It’s high time regulatory bodies step up and ease the licensing terms and open the conservative banking system. The developed world has moved to Open banking, borderless banking, and PSD2. More than 100 challenger banks are operational worldwide today. With the high chances of Challenger banks coming in the future, traditional banks would be battling to match up.

As of April 2019 as per RBI records, India has 142 high street banks (22 -private, 20 -public, 56 -rural, 44 -foreign) and 7 payment banks. If we consider all private and public banks i.e. 42, they offer almost zero differentiation in terms of their offerings. Whatever differentiation exist is unknown to consumers. Same holds true for 44 foreign banks. All the banks operating in India are very transactional in their customer engagement with innovation and customer value taking a back seat. Despite being the 6th largest economy, India has not produced a single bank of global repute. Even in 2019, banks continue to make unsolicited calls to sell loans and credit cards to every random customer they have and they keep making calls even when you say them No. There is an absolute need for data analytics understanding user behavior and needs and identifying high-value target customers. Few payment banks like Airtel payments and Paytm started as a payment wallet gradually widening services to include cash deposits, mobile recharges and utility payments. Paytm offers debit card and even interest on savings. Still, there is a long way to go as far as user needs are concerned. So, what is it that user needs and how it can be met?

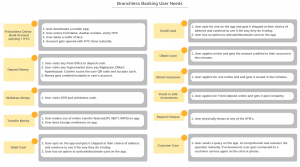

Let’s consider a user persona with the following characteristics – An upper middle class 18-35 year old living in Tier 1 and Tier 2 cities. This persona would have the following needs –

With Fin techs mushrooming across the country solving user needs in each of the niche areas – Insuretech, banking, trading or lending; the future calls for plug and play economy. Ground work is already being laid down.

So how would the future look like?

At some point in the future, regulatory bodies have to clear a path towards open banking. High street banks will see a lot of consolidation happening, a number of manual jobs vanishing, and some transforming to cater to Gen Z user needs. We will see Challenger banks being born with the sole purpose to disrupt the current incumbents. Their possible approach would be to attack a new market segment or develop a new value chain or overlap the current offerings with low OPEX and innovative features with digital experience taking the foremost importance. Technologists, Designers, Product leaders and domain experts will lead the way to design the future banks. Bank Branches would possibly become redundant. Certain aspects of digital experience are already led by Paytm, PhonePe, Bankbazaar, Policybazaar, etc to name few. Government-led initiatives like UPI and Aadhar service stack have laid the foundation for the next digital wave. Future will see paperless, motionless and presence less banking experience. Deposit Cash user need can be addressed by Challenger banks tying-up with post offices, supermarket chains like Big Bazaar, Cafe Coffee Day, etc. The next generation expects all banking experiences through the touch of their screen. First & Second movers will have a significant advantage to create noise in the market and acquire hordes of customers with minimal acquisition cost.

Open banking initiatives started in Europe and are now gradually spreading to developed countries across the globe. Hong Kong published an open API framework. They issued around 20 new banking licenses in the year 2018 alone. Singapore published a set of 121 APIs spanning full customer life cycle. Australia is about to open by July 2019. Japan has already laid down recommendations and banks are expected to open the data by 2020. The Canadian government is in the discussion phase. India has different sets of challenges altogether – 190 million unbanked users, 2nd highest after China and a high number of public sector banks. The country has led lots of initiatives in the last 5 years with Jan Dhan zero balance accounts targeting rural regions. Open banking if implemented sooner will only yield out benefits to unbanked users at a fast pace with several fin techs building innovative solutions on top of open API’s.

In UK, consumer research showed that the more digital the bank goes, the customer loyalty lessens. That’s possibly going to happen in every other market when digital banking matures, ease of accessing different services will improve, and the differentiation among offerings would be minimal. You will possibly have one dominating marketplace selling bank accounts, credit cards, loans, insurance as a commodity from different banks and financial institutions just like you shop televisions on Amazon. In UK, the big banks are already playing catch up game following exactly what challenger banks are doing. In China, tech giants are now becoming technology providers to banks building a plug and play micro services-based model replacing in-house banking infrastructure. In Germany, Fidor and N26 are two interesting examples reinventing banking from the core. It would be interesting to see tech companies like Facebook, Amazon, Flipkart, Paytm and Google making use of the open API’s to offer personalised customer experience both in terms of data and advertisements to their Indian users.