The dietary supplements market in India is expected to grow CAGR of ~16% from 2019 to 2023 and India is supposed to be the most populous country in the world by 2024( Source – World Population Prospects: The 2017 Revision by the Department of Economic and Social Affairs of the United Nations).

Vitamins and minerals constitute 40% in the Indian dietary supplements market followed by the herbal segment contributing 30%, proteins segment contributing 25% and other segments contributing around 5% of the total market. Indian companies have by large failed to produce high-quality protein supplements, but in the last few years, new brands have started entering the standard supplement market. One size fits all model does not seem right as every individual has unique goals and needs supplement customised to meet that need. There are still no players in India in the custom subscription segment like takecareof, persona nutrition in the US and vitl in the UK.

There are five key demand drivers in India which have resulted in the growth of vitamin and protein supplements –

- Increasing awareness of fitness in the last decade in urban and rural regions, the number of fitness centers mushrooming rapidly and easy access to information

- High malnutrition rate in rural areas, Micronutrients deficiency among pregnant women

- Rise of high disposable income working population with a stressful lifestyle in big cities and changing dietary patterns

- High costs of hospitalization driving consumers towards precautionary health supplements

- Friends and family members trying out supplements due to ease of availability both online and offline – If one person in the family tries, they influence other family members.

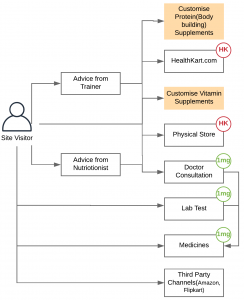

HealthKart competes with Neulife, HealthyWorld, and Healthgenie in the health supplement segment. Below figure depicts Healthkart’s line of businesses.

HealthKart and its partner company 1mg caters end-to-end when it comes to user healthcare needs. Whether you need a doctor consultation, a lab test appointment, purchase medicine, advise from nutritionist or fitness trainer, purchase vitamin and protein supplements; you get it all on the platform.

As an outsider, when I look at the current portal from the Product manager’s lens, I see a strong potential in improving certain KPI’s –

Lifetime Value of a Customer(LTV) – Tremendous Cross-selling and Up-selling opportunities

Building a new customer base – Customisation and subscription model has a potential appealing to Gen X with back-end capabilities including manufacturing and logistics already in place

Reducing Marketing Cost – Targeted marketing with users browsing data spread over several product lines

Customer Retention – Building multi-year subscription plans on lab tests, medicine refills, and subscription based vitamins delivery

Nutritionists consultation can be replaced or augmented with an Artificial Intelligence algorithm capturing information from the user in the questionnaire form and recommending user the best vitamin/mineral formula custom made for the user. Similar model can be built for Protein supplements.

I have prepared a short prototype depicting how the user experience would look like – starting with a series of questions and every next question determined basis users’ answer to the last question. In the end, system will show the recommendations with the ingredients and dosage information which user can proceed to buy online and get it shipped at their doorstep. Keep clicking on Continue button on the pages below else to open in a new browser window click Automation Engine User flow